BeachSeeker

Nomad

Posts: 102

Registered: 6-6-2023

Member Is Offline

|

|

Anyone Run an AirBnB in Baja?

We are seriously looking to buy in Baja in the near future, but are maybe 7-8 years from living there full time. We run a successful AirBnB in San

Diego, and would like to rent the Baja home when we are not using it. Does anyone have any experience running an AirBnB in Baja? Specifically we are

looking to better understand VAT and Mexican income tax as a non-resident without an RFC.

If anyone has any experience and wouldn't mind chatting a little about it, please let us know. Thanks!

|

|

|

4x4abc

Ultra Nomad

Posts: 4217

Registered: 4-24-2009

Location: La Paz, BCS

Member Is Offline

Mood: happy - always

|

|

tax number or not - the gov will take about 20% from the top

Baja has been flooded with investors creating rentals

that of course has pushed prices down

downtown rentals have now US price level (La Paz)

edge of town:

https://www.airbnb.com/rooms/33074662?source_impression_id=p...

Harald Pietschmann

|

|

|

shari

Select Nomad

Posts: 13037

Registered: 3-10-2006

Location: bahia asuncion, baja sur

Member Is Offline

Mood: there is no reality except the one contained within us "Herman Hesse"

|

|

I have an air BnB listed and yes it is tough with all the taxes and fees if you are legal which I am. I struggle with competition from people who

arent legally doing business....grrrrrr.

|

|

|

surabi

Ultra Nomad

Posts: 3590

Registered: 5-6-2016

Member Is Online

|

|

That is incorrect.

With an RFC:

Airbnb charges the guests the 16% IVA and the state occupancy tax (which varies by state from 3-6%, I believe. They pay out half that IVA to

the host to submit to SAT and supposedly remit the other half to SAT directly. They also pay out the occupancy tax to hosts , who are required to

submit it. But all that money comes from the guest, not off the host's earnings. And if you have an RFC, you can deduct any facturas you can get for

expenses, with your tax number on it.

Additionallly, with an RFC, Airbnb withholds and pays to SAT 4% income tax. So the only cost to hosts that comes off the top is Airbnb's 3% host

sevice charge, and 4% income tax, 7% in total, not 20%.

Without an RFC:

Taxes will be charged to guests as above, but all will be withheld rather than sent to the host to submit. Additionally, instead of 4% income tax

being withheld, 20% is. And without an RFC number, you can't get any facturas for expenses to be able to deduct.

I don't quite understand what Shari means about struggling to compete with those who aren't paying taxes- Airbnb is required to charge the taxes by

SAT, so all listings will be paying those taxes. It used to be possible to list and not pay taxes, but since Airbnb was forced to charge and collect

the taxes a couple, three years ago, it's no longer possible to fly under the radar.

And 4x4- if you have an RFC, I don't know why Airbnb is withholding 19% income tax- there's something wrong there.

[Edited on 11-22-2023 by surabi]

|

|

|

4x4abc

Ultra Nomad

Posts: 4217

Registered: 4-24-2009

Location: La Paz, BCS

Member Is Offline

Mood: happy - always

|

|

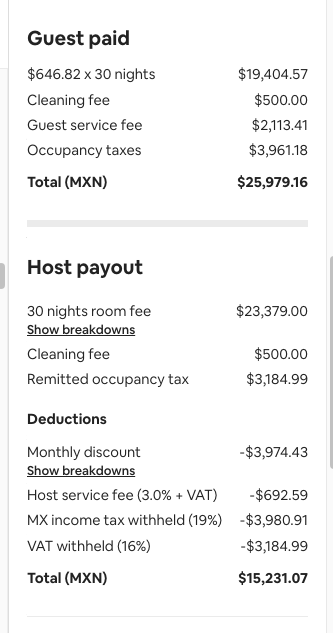

well, I have an RFC and the example above is my ls booking

nobody to talk to at airbnb - they do what they do

Harald Pietschmann

|

|

|

BeachSeeker

Nomad

Posts: 102

Registered: 6-6-2023

Member Is Offline

|

|

Thanks for all of the replies.

Surabi, I'm following everything you are saying, except for you say income tax is only 4% with an RFC. Isn't income tax (ISR) rate based on income?

From what I can tell, once you make over $13,381 pesos per month, your ISR tax rate is over 21% anyhow, more than the 19% that AirBnB withholds.

Harald, thank you for the screenshot! Do you have an RFC? Do you pay anything in addition to what AirBnB charges the guest and withholds from you? Do

you report the income separately, or just let the 19% that AirBnB withholds cover it?

|

|

|

surabi

Ultra Nomad

Posts: 3590

Registered: 5-6-2016

Member Is Online

|

|

Quote: Originally posted by 4x4abc  | well, I have an RFC and the example above is my ls booking

nobody to talk to at airbnb - they do what they do |

Airbnb CS is indeed extremely frustrating to deal with, you have to be extremely patient and persistent, but yes, there are people to talk to. If you

registered with Facturify through Airbnb, you should only have 4% withheld. You have to set up a Facturify account, not just enter your RFC number in

your Airbnb account. You have to ask Airbnb how to do that. They sent out emails about it a couple years ago.

That your breakdown above also shows that Airbnb has withheld the entire 16% IVA, when they release 8% of that to the host if you are registered,

tells me you never filled out the Facturify form.

[Edited on 11-22-2023 by surabi]

[Edited on 11-22-2023 by surabi]

[Edited on 11-22-2023 by surabi]

|

|

|

surabi

Ultra Nomad

Posts: 3590

Registered: 5-6-2016

Member Is Online

|

|

Quote: Originally posted by BeachSeeker  | Thanks for all of the replies.

Surabi, I'm following everything you are saying, except for you say income tax is only 4% with an RFC. Isn't income tax (ISR) rate based on income?

From what I can tell, once you make over $13,381 pesos per month, your ISR tax rate is over 21% anyhow, more than the 19% that AirBnB withholds.

Harald, thank you for the screenshot! Do you have an RFC? Do you pay anything in addition to what AirBnB charges the guest and withholds from you? Do

you report the income separately, or just let the 19% that AirBnB withholds cover it? |

You have to report the income if you have an RFC. Airbnb just submits the taxes. If you don't have an RFC, you can't report your income.

As far as the tax rate, yes, it is based on income. But if you have an RFC, as I said, you can deduct expenses you have facturas for. For instance, I

can deduct my gas, internet, electric bills, dental bills, etc. And I just rent a private room/ bath for one guest. So my Airbnb income isn't as high

as 13,381/month and I really only have a viable 6-7 month booking window. It's too hot and humid in the summer to get tourists where I live. The

tourists who do come want apool and AC, which I don't have.

However my accountant works her magic, I have not had any taxes owing at the end of the fiscal year. (You report income and pay taxes monthly, but

there is a year end statement which resolves everything- for instance, my dental bills can't be deducted monthly- they are deducted from any taxes

owing at the end of the year)

|

|

|

surabi

Ultra Nomad

Posts: 3590

Registered: 5-6-2016

Member Is Online

|

|

Quote: Originally posted by lencho  | Quote: Originally posted by surabi  | | I don't quite understand what Shari means about struggling to compete with those who aren't paying taxes- |

Not all landlords use AirbNB. Many Mexicans I know who rent out their properties do so by word of mouth or other informal means and do NOT report

that income to Hacienda.

I suspect it's harder for a Gringo to fly under the radar. |

It's not hard to fly under the radar if you rent directly, regardless of whether you are Mexican or Gringo. But you'd have to have a low-key rental

that didn't draw attention. A big house that sleeps 10 people, who party and disturb the neighbors is going to get neighbors complaining, and if they

are mad enough, report you to the authorities. My neighbors wouldn't even know I had Airbnb guests, or some who book directly through word of mouth,

or because they are repeat guests who booked through Airbnb the first time, because I only host 1 guest at a time and most take the bus here from the

airport- they don't even have a car. As far as anyone else would know, they are just friends or family who came to visit.

I don't know that there are many Mexicans who do short term rentals without paying taxes and advertising on a short term rental site- how would

tourists find out about them? Long term rentals, sure.

|

|

|

4x4abc

Ultra Nomad

Posts: 4217

Registered: 4-24-2009

Location: La Paz, BCS

Member Is Offline

Mood: happy - always

|

|

Quote: Originally posted by BeachSeeker  |

Harald, thank you for the screenshot! Do you have an RFC? Do you pay anything in addition to what AirBnB charges the guest and withholds from you? Do

you report the income separately, or just let the 19% that AirBnB withholds cover it? |

I have nom additional charges/taxes to pay

yes, I have an RFC

I report my income through an accountant

Harald Pietschmann

|

|

|

BeachSeeker

Nomad

Posts: 102

Registered: 6-6-2023

Member Is Offline

|

|

Quote: Originally posted by surabi  |

You have to report the income if you have an RFC. Airbnb just submits the taxes. If you don't have an RFC, you can't report your income.

As far as the tax rate, yes, it is based on income. But if you have an RFC, as I said, you can deduct expenses you have facturas for. For instance, I

can deduct my gas, internet, electric bills, dental bills, etc. And I just rent a private room/ bath for one guest. So my Airbnb income isn't as high

as 13,381/month and I really only have a viable 6-7 month booking window. It's too hot and humid in the summer to get tourists where I live. The

tourists who do come want apool and AC, which I don't have.

However my accountant works her magic, I have not had any taxes owing at the end of the fiscal year. (You report income and pay taxes monthly, but

there is a year end statement which resolves everything- for instance, my dental bills can't be deducted monthly- they are deducted from any taxes

owing at the end of the year) |

Dental bills? How are your dental bills a rental expense?

|

|

|

surabi

Ultra Nomad

Posts: 3590

Registered: 5-6-2016

Member Is Online

|

|

They aren't a rental expense, that's why they aren't calculated into the monthly statements as deductions from rental income, only at year-end. Just

as in the US or Canada, there are things that can be used in your yearly tax filing to reduce the amount of taxes owed.

|

|

|

surabi

Ultra Nomad

Posts: 3590

Registered: 5-6-2016

Member Is Online

|

|

@ Beachseeker, your point by point responses to my post on your other thread are super arrogant and contain uncalled-for personal attacks. I was just

trying to save you from making the same mistakes a lot of other people do (and sorry, I didn't remember you were the same poster from this thread),

which you decided to take as some personal attack or assumption that you were stupid or incompetent.

And no, I haven't experienced any of the issues I mentioned on the other thread because I am not a remote host- I live in Mexico full time and host

guests in the home where I live and have had an RFC and been paying Mexican taxes on my businesses for 18 years. I just know lots of other hosts who

try to manage a rental in Mexico remotely, and have had the kind of issues I mentioned.

|

|

|

BajaBlanca

Select Nomad

Posts: 13172

Registered: 10-28-2008

Location: La Bocana, BCS

Member Is Offline

|

|

We used to do airbnb in La Bocana and it worked really well at the time. It was challenging to set it up room by room, but I did it.

Just last week I used airbnb to travel to the capital of Turkiye and because I wrote a raving review, it brought up our reviews as hosts at the hotel.

So fun to read.

We still run the hotel and have a neighbor who runs the day to day business. Our income is reported to our accountant in La Paz. I highly recommend

her if you are looking for someone. We have another very good friend who has used her as well, for all his businesses.

ISABEL MENDEZ whatsapp +52 612 108-9089

|

|

|

BeachSeeker

Nomad

Posts: 102

Registered: 6-6-2023

Member Is Offline

|

|

Thank you BajaBlanca!

|

|

|